RBI’s digital rupee, KCC loan innovations displayed at G20 FMCBG event in Gandhinagar

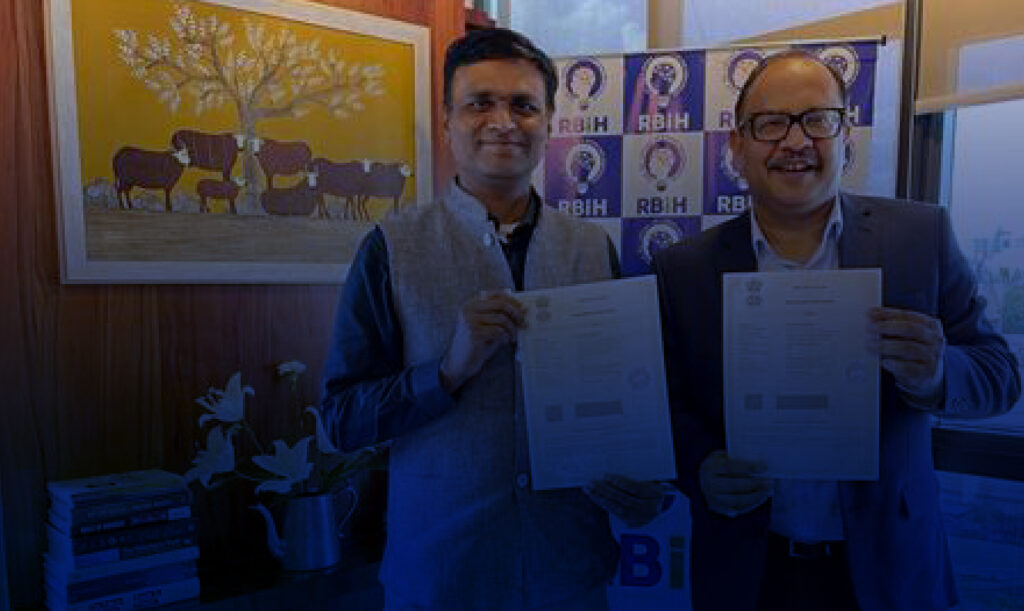

The Reserve Bank of India (RBI) has showcased its innovations — ‘Frictionless Credit’ and ‘Central Bank Digital Currency’ — at the innovation pavilion on the sidelines of the 3rd meeting of Finance Ministers and Central Bank Governors (FMCBG) under India’s G20 presidency here at the Mahatma Mandir Convention Centre. The G20 event is underway in Gujarat’s […]

RBI’s digital rupee, KCC loan innovations displayed at G20 FMCBG event in Gandhinagar Read More »