Swanari TechSprint

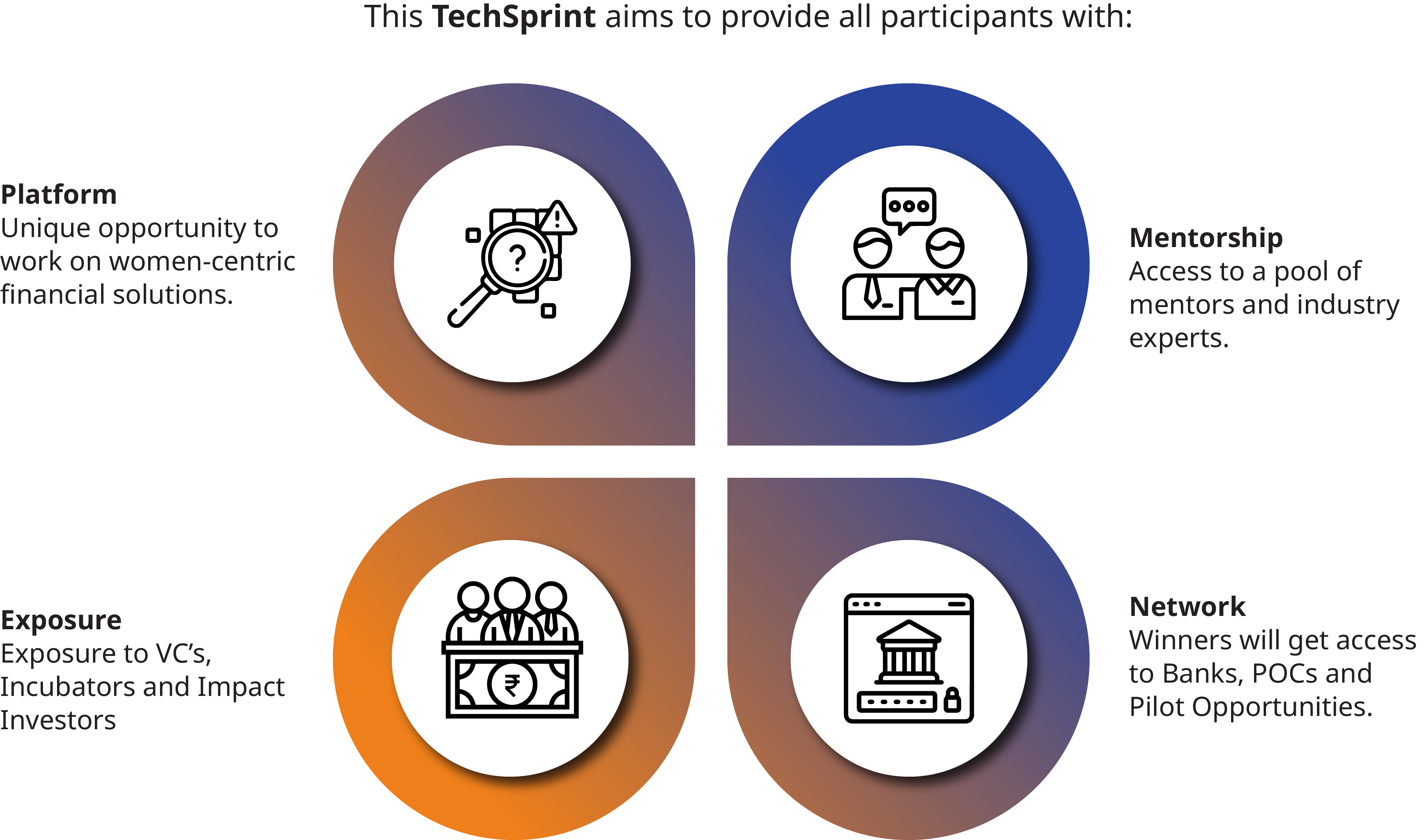

RBIH’s Swanari TechSprint provides a platform to conceptualise, develop and support innovations in technology that enhance access, usage and quality of financial services for all women in India.

Through this, RBIH aims to create an ecosystem of fintechs and tech providers who are bridging the gender divide in financial services responsibly and transparently.

Congratulations to the Winners of Swanari TechSprint 2023!

Kaleidofin Capital private limited

Based out of Tamil Nadu, Kaledofin is a digital lending solution with a vision of propelling customers towards their financial goals through tailored financial solutions.

MeraKal

Based out of Karnataka, MeraKal is a fintech startup with a vision to transform the way lower-middle income customers can manage their finances.

Vitto

Based out of Delhi, Vitto is a vernacular banking fintech with a vision of simplifying finance through appropriate audio-visual assistance.

Problem Statement for the Swanari TechSprint 2023

End to End Digital Straight Through Process (STP) lending for micro to medium-sized women owned enterprises.

Customer Persona

Preferred segment: Informal women-owned businesses including but not limited to – street vendors, shopkeepers, traders, micro and small manufacturers or other micro-service providers

Customer persona: An Indian women-owned micro to medium-sized enterprise, a thin-file or no-file entrepreneur with minimal formal credit history, who has minimal or no collateral to offer and therefore opts for more expensive informal or semi-formal sources to finance her business

Credit requirements: In the range of Rs. 50,000 to Rs. 10,00,000 to operate and grow her business

Have Something to Tell Us?

Let’s hear yours.